An overview of the analytical instrumentation market

Data taken from Top-Down Analytics (TDA) Research report: 2021 TDA Instrument Industry Outlook Report.

Top-Down Analytics has released its updated report entitled 2021 Instrument Industry Outlook Report. This past year has been unlike any other and coming off the back of a worldwide pandemic, it is more vital than ever to know how and where the market will rebound. In 2020, the lab and analytical instruments industry was in the unusual position where, dependant on the technology, there were suffering losses or steep gains. Looking forward, the outlook for 2021 is modest and outlined in the report are the sectors within the analytical instrumentation market that are set to gain more throughout the next year.

This new report provides information on the economic factors that are driving growth and impacting instrument sales. It provides growth estimates and unit shipment data for over 70 analytical instrument technologies, within categories including chromatography, mass spectrometry, microscopy, lab automation, lab enclosures and furniture. The newly published 2021 Outlook Report provides insight into market performance and expectations both for products, market opportunities and growth.

Statistics from 2020

According to TDA, in 2020, the lab and analytical instruments market increased 2.9% to $66.9 billion, despite the unexpected impact of the pandemic globally. Broken down by market, lab instruments grew moderately, process analytical instruments (PAI) fell substantially, and lab enclosures and furniture fell moderately.

Growth of all technology segments slowed in 2020, except for life science instruments and lab automation, both of which include instrumentation for combatting COVID-19.

Activity in end markets

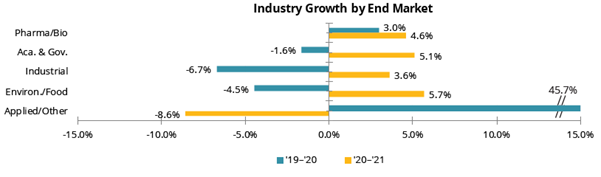

It was clear that the market for analytical instruments, because of the products it covers, would benefit in a way from the pandemic in 2020. The clinical, diagnostics, and other applied end market all inflated almost 50%, in response to the pandemic’s call for urgent and increased activity in clinical labs. Equally the pharmaceutical/ biopharmaceutical market saw a 3% rise in growth. By region, demand from Europe rose fastest with the North American market also experiencing solid growth.

Vendor market share

TDA has approximated the 2020 industry revenues of the companies providing products and services for the lab and analytical instruments market. Most of these companies’ offerings are distributed across several technology sectors. The top 50 vendors in the lab and analytical instruments industry represent more than three-quarters of the $66.9 billion market in 2020. The distribution of market share is highly skewed; the 10 companies with the highest revenues collectively have more than half of market share, up a few points on the year prior.

Looking at 2021

As most analytical technology segments recover from the pandemic they will accelerate in growth. However, the double-digit demand for life science and lab automation technologies will revert back to normal levels. TDA expects the molecular spectroscopy, atomic spectroscopy, and mass spectrometry (MS) segments to lead industry growth, each expanding by mid-single digits. Geographically, China will lead in markets, as it continues on its path of growth. Of the end markets, non-essential activities will resume and bolster the food and environmental testing market, helping it to expand the most. As the effects of COVID-19 begin to recede, demand from the clinical/ diagnostics/ other applied markets will lose traction.

TDA predicts that with certain key economic factors for 2021, growth of the lab and process analytical instruments industry will rise by 2.4%, to reach $68.5 billion. Broken down by market, lab instruments will grow modestly, PAI will increase moderately, and lab enclosures and furniture will shrink slightly.

Making the most of market insight

This kind of market insight is invaluable. The projections should help validate your future plans including target markets and end-user segments. Putting dollar values against market growth in your segment and thus monetising the growth you are aiming for, will help you to focus clearly on the best opportunities for analytical instrumentation in 2021.

We work closely with clients in many of the segments outlined in the report and help companies to communicate better with their complex audiences to grow awareness, change perceptions, generate demand and ultimately, grow market share, in China, North America and Europe.

To buy the full report, click here.

Contact us to find out more about communicating with laboratory markets, in China, North America and EMEA.